Student Debt Bubble 2 Times The Size Of Credit Card Debt

The cost of a 4-year, public college has increased 158% since the early 1990s.

A portion of monthly subscriptions goes to groups supporting our unhoused friends and neighbors. Please consider subscribing.

It’s difficult to pinpoint exactly how my student debt makes me feel. Exasperation. Rage. Despair. Despondency. Nihilism. They all fit. It changes from day to day.

I didn’t go to elite, private schools. My parents didn’t go to college and in high school I didn’t really think I had much of a future. So, for undergrad, I went to Youngstown State University, a cheap-ish public university in Ohio. People in the area liked to say YSU stood for “You Screwed Up” because its open-enrollment policy and low barrier to entry—academically speaking—led to many students attending because they couldn’t get in anywhere else. And that also meant it was a lifeline for people in northeast Ohio and western Pennsylvania who have been subject to deindustrialization and the economic fallout that followed. I’m grateful I went there. And even though it was relatively affordable compared to its more prestigious in-state competitors and despite working multiple jobs while in college, I still left with some debt.

After a few years in the workforce, I decided to pursue a Masters in Public Administration part-time in hopes of advancing my career. It was brutal. Between a full day’s work, late-night coursework and three and a half years of almost no free weekends it was finally finished in December 2019. 2020 was going to be my year. With grad school out of the way, I finally had free time to do things that were always out of reach and unaffordable. Like, say, travel. Can’t remember what happened at the onset of 2020 but I’m sure my plan came to fruition. Anyway, that program—which I really did appreciate—brought my total debt up nearly $90,000.

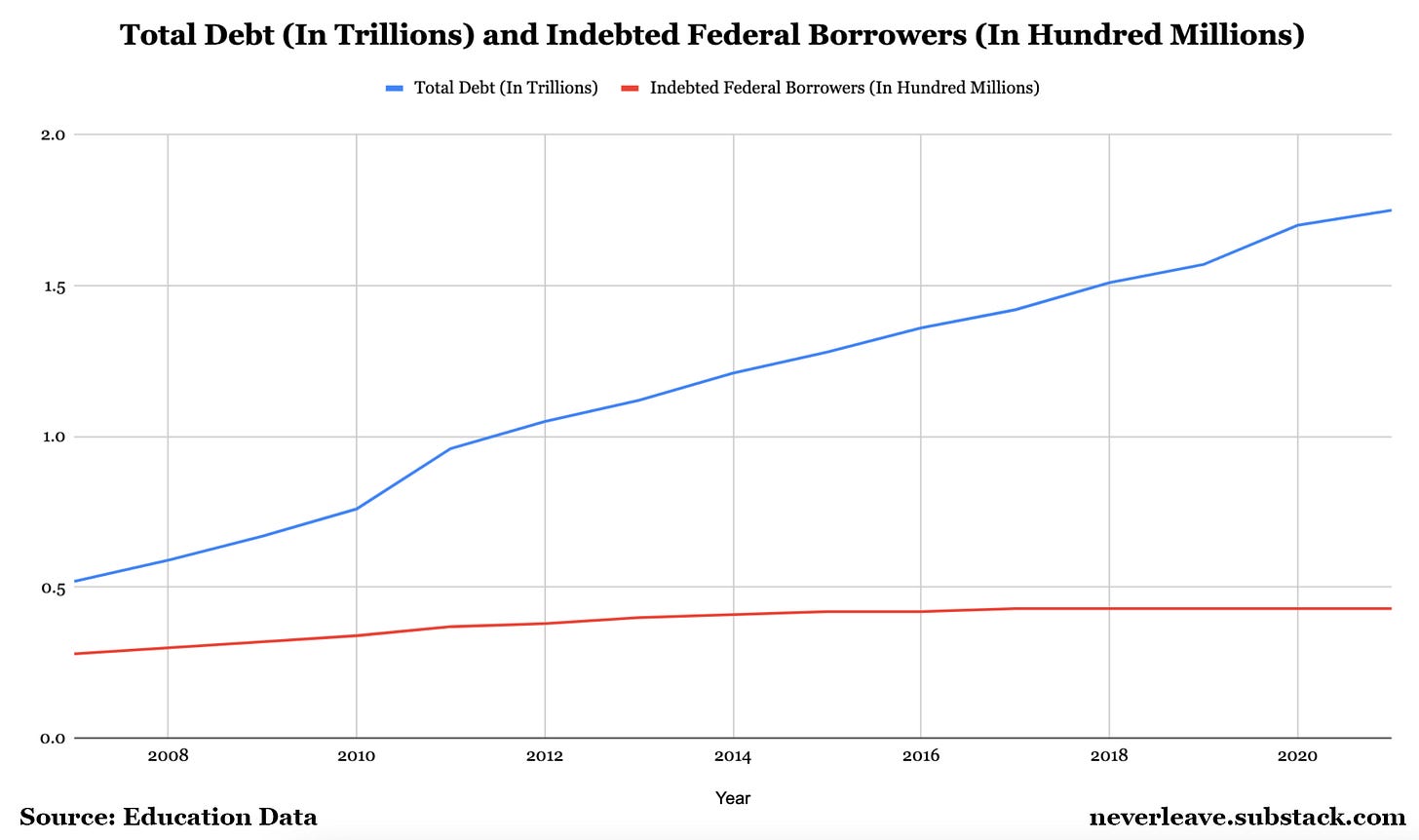

I’m one of the 43.4 million Americans who owe more than a collective $1.7 trillion in student loan debt. Feels great. The average federal balance is $37,014 per borrower, with the total (including private loans) balance a few thousand more.

According to the College Board’s 2021 Trends In College Pricing Report, the average annual tuition and fees at public, 4-year colleges have risen from $4,160 to $10,740—a 158% increase, since the early 1990s. At private institutions there has been a 96.6% increase during that same period, with tuition and fees increasing from $19,360 to $38,070.

Source: The College Board

These cost increases, coupled with interest on loans, has led to ballooning student debt despite the number of borrowers remaining relatively stagnant.

To put the total cumulative student loan debt into perspective, it overshadows all auto loan debt in the United States, $1.46 trillion, as well as total credit card debt, $841 billion.

Organizers and activists have been calling for student debt relief for years. Recently, it’s become more of a popular stance in Washington. In December, Senators Elizabeth Warren and Chuck Schumer along with Representative Ayanna Pressley sent a letter to the White House requesting the Biden administration cancel $50,000 of student loan debt for every borrower, something they say would add over $173 billion to the GDP the first year, as millions of borrowers would no longer have that financial burden holding them back.

Joe Biden even ran on debt cancellation:

And that’s what’s frustrating about this. He could cancel debt with the stroke of a pen. Despite initial claims by the administration that their hands were tied, Biden absolutely can cancel student loan debt. All of it. Watch:

And beyond the clear legal explanation from our friends at More Perfect Union, he’s already done it. Multiple times! In September 2021, the Biden administration cancelled around $1.5 billion in loans under the borrower defense to repayment rule, which aided borrowers who were misled by their schools. In February 2022, another $415 million. In March, another $1 billion. In June, another $5.8 billion. These are just a few examples. They’ve been tinkering around the edges since he entered office, cancelling around $31 billion in total.

That debt forgiveness is great. Those people deserve relief. And while sporadic cancellations generate positive headlines for the administration, here’s some context:

The issue is so many more borrowers need relief too. Not just for college graduates, either. The six-year graduation rate is only 63%. While it’s difficult to pinpoint the exact number of borrowers who never completed a degree, the best estimates are around 4 in 10 borrowers. That is millions of people who have nothing to show for their potentially tens of thousands in debt holding them back in life. Surely they warrant forgiveness.

And this is a racial justice issue as well, this is a problem—like so many in our society—that disproportionately impacts Black and Latinx people. “90 percent of Black students and 72 percent of Latinx students take out loans to attend college in comparison to 66 percent of white students, and on average, Black borrowers take on nearly 50 percent more debt for a Bachelor’s degree than white peers,” a study by the Student Borrower Protection Center found.

Analysis by the Roosevelt Institute found that “canceling up to $50,000 of student loan debt per borrower would immediately increase the wealth of Black Americans by 40 percent.”

The NAACP has also been calling for a minimum of $50,000 cancelation per borrower. Doing so, they point out, would “fuel upward mobility in the Black community and equitable efforts to close the racial wealth gap” as well as increase discretionary income among Black families and increase Black home ownership. These are great things the administration should prioritize.

But despite the campaign pledges and occasional cancelations, nothing substantive has been done. The current timeline is “late summer” for any announcement by the administration but earlier in the year Biden said he wasn’t considering $50,000 worth of forgiveness.

The immediate response the debt crisis must be full cancellation. It does not, however, address the cost of higher education. Opponents like to use this as an excuse not to cancel debt, but they’re relying on a dysfunctional Congress and state legislatures to justify inaction at the executive level. But using executive powers to ameliorate borrowers financial woes is the necessary thing to do while purportedly sympathetic parties still control the White House.

The Student Debt Crisis Center has already collected over 1.2 million signatures on a petition calling on Biden to cancel student debt which you can sign here. The Debt Collective has a tool that allows you to email your Representative to call on them to demand they support student debt cancellation and take the issue to the President which you can use here.

Thank you for reading. If you enjoyed this piece, please share it and leave a comment. And if you’d like to subscribe to this Substack, can do so below. A portion of proceeds from monthly subscriptions goes to groups supporting our unhoused friends and neighbors.

Photo courtesy of Yinan Chen/Creative Commons

I have two college degrees, and Pressidente Biden can cancel all this debt with a stroke of the pen! It's that easy! It's as easy as taking out a loan!

Did I mention that I've not yet made any payments of my own to pay down the debt that I signed myself up for?

Cancelled does not mean "Cancelled." The banks still get their money -- that is the way that the program was set up. It only means that the taxpayers at large pay the debt instead of the borrower, because (I repeat) the banks are still going get their money.