Rent Prices Growing Four Times Faster Than Income

The median national rent exceeded $2,000 in May for the first time ever.

A portion of monthly subscriptions goes to groups supporting our unhoused friends and neighbors. Please consider subscribing.

Housing is a human right. The idea that only people with sufficient income should be able have a place to live, let alone live comfortably, is ludicrous. But the United States does not recognize a right to housing. While there have been some unsuccessful attempts to change that, a recent study reveals just how dire conditions have become for the millions of Americans who rent.

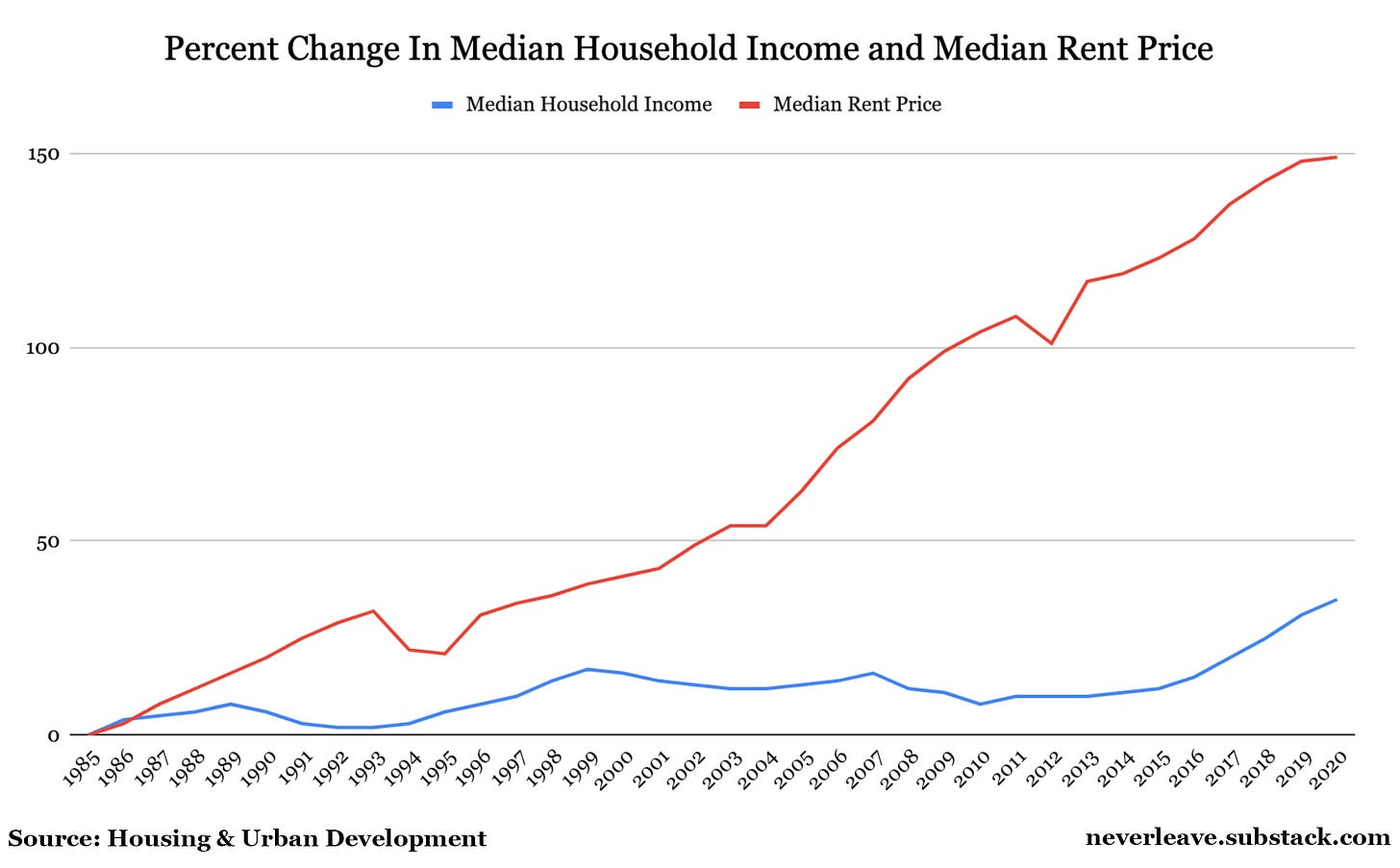

Using data from Housing and Urban Development, the Federal Reserve of St. Louis and the U.S. Census Bureau, Clever Real Estate found that national median rent prices have risen four times as much as median household income since the 1980s.

“From 1985 to 2020, rent prices increased 149%, while income grew just 35%,” the study says.

Meanwhile, all over the country rents are exploding. Another study, this one from real estate brokerage Redfin, illustrates how overpriced housing in the United States has become. For the first time ever, the median national asking rent exceeded $2,000 a month. Over $24,000 a year. To have a roof over your head. This doesn’t guarantee any added comfort or level of furnishings. For some perspective, the median national monthly asking rent in May of 2021—just one year ago—was $1,738. That’s a 15% year-over-year increase.

In some cities, rents have skyrocketed beyond 15% from May 2021. In Boston, rent is up 17%. New York, 24%. Miami, 29%. Cincinnati, Nashville & Seattle all saw rents rise 32%. And rents in Austin, one popular destination of Californians fleeing the Golden State, are up a whopping 48%. Only three of the top 50 major metropolitan areas saw rents decline. Minneapolis is down -2.8%. Kansas City, -2.9%. And Milwaukee is down -10%.

These rate increases are putting an added strain on working people who are already stretched too thin. A Pew Research study in 2021 found that around 36% of the country rents, with 65.9% of people 35 and younger being renters. According to the National Multifamily Housing Council, over half of all apartment homes were paid more than 30% of their income on rent, classifying them as “cost burdened.” Even worse, the Center on Budget and Policy Priorities estimates 23.4 million people pay more than half their income on rent. With inflation reaching a 40-year high and two-thirds of Americans living paycheck-to-paycheck, living a stable and secure life is increasingly more difficult.

If you’ve never lived paycheck-to-paycheck, I hope you understand how lucky you are. The anxiety it creates eats at you in ways you don’t even fully understand as its happening. For me, there was a constant feeling of body tension. I found myself living in constant fear of something, literally anything, going wrong and immediately draining what little money I had left in my account. I skipped meals often, I would seldom buy new clothes, and rarely spent anything on entertainment or anything outside of my apartment.

Rent was the primary driver of that anxiety. I could barely afford it despite working a “salaried” job. (It ended up shaking out to about $15 an hour before taxes.) It got to a point where I would pay between 50-70% of my rent when it was due, then pay off off the balance when I got my next paycheck and before I got evicted. I realized the eviction process in my area would automatically be stopped and dismissed if I paid off my balance before the court date, so I would use this just to give myself a bit more breathing room. I would hurry home after work on days before the remaining balance had been paid in an attempt to remove the eviction notice off my door as soon as I could to minimize how many of my neighbors saw it. The embarrassment added to the economic anxiety.

But even if people are able to buy a home, they’re up against corporate giants who are gobbling up single-family homes in bulk, to the tune of $60 billion. As a result, 2.5 million families looking for their first home will be edged out. The Washington Post reports this has disproportionately impacted Black neighborhoods.

And, as I’ve mentioned in other posts, real hourly average wages are down 3% from May 2021 due to rising inflation. A recession—something that some economists warn is coming—coupled with historic levels of inflation coming at a time as the few remaining COVID-era eviction moratoriums are expiring and without federal aid and intervention would be catastrophic for the working class.

But landlords seldom make adjustments or freeze rent to accommodate for broader economic woes without being forced to do so because they’re only concerned about profit. So, instead, working people have to make sacrifices on their own just to keep a roof over their head. But it doesn’t have to be this way. These issues are preventable. And despite the lip service from some members of Congress, there isn’t a substantive, legislative response to the growing issue of rising rent. One of the best things we can do is implement national rent control. A handful of states and localities are trying to implement it, but a majority of states (37) have laws that preempt rent control.

Source: National Multifamily Housing Council

Prof. Richard Wolff has a good breakdown on the success on rent control here:

Beyond that, we must have a major investment in public housing. There’s a stigma associated with public housing because of cuts over the years, despite its successful origins. One example of a successful long-term solution to prevent against worst-case scenarios can be found in Finland. There, the government provides small apartments for people experiencing homelessness—no questions asked—and found that it’s ultimately a more cost-effective solution than criminalizing poverty and hoping the problem magically disappears. The “housing first” approach, unsurprisingly, resulted in a sharp drop in homelessness.

Renters should not be seen as profit centers for the investor class. People need a place to live just like they need food, water and clothing. We must put an end to profiteering on the backs of the working class, especially in housing. A better world is possible.

Thank you for reading. If you enjoyed this piece, please share it and leave a comment. And if you’d like to subscribe to this Substack, can do so below. A portion of proceeds from monthly subscriptions goes to groups supporting our unhoused friends and neighbors.

Photo courtesy of cincy Project/Creative Commons.

Rent Control doesnt work. Just makes it more expensive. Read a Basic Economics book and learn about scarcity.......

Occupancy rate of boarding houses latest please 🥺