75% Of Middle Class Households Say Their Wages Aren't Keeping Up With Inflation

Meanwhile, the average S&P 500 CEO-to-worker pay ratio hit 324-to-1 in 2021.

A portion of monthly subscriptions goes to groups supporting our unhoused friends and neighbors. Please consider subscribing.

From cutting back on groceries or skipping meals, to neglecting medical care to even delaying rent and mortgage payments—we’ve discussed the many ways working people have struggled to keep up with the rising cost of living in the United States. A new study illustrates just how widespread the problem is and how fearful they are about the future.

75% of middle-income families say their wages are falling behind inflation, according to a new report from Primerica and Change Research. 77% say they’re expecting and preparing for a recession, with 71% already cutting back on spending to help make ends meet.

This underscores how unjust living conditions have gotten in the United States because of decades of wealth hoarding at the top. And a new report compiled by the AFL-CIO shows just how well the corporate elite are doing.

The average S&P 500 CEO received $18.3 million in total compensation in 2021, an increase of 18% in one year. During that same period, average hourly earnings for workers fell 2.4%.

“Last year the average CEO-to-worker pay ratio of S&P 500 companies was 324 to 1. In 2020, it was 299 to 1. And in 2019, it was 264 to 1,” Fred Redmond, AFL-CIO’s Secretary-Treasurer, said in a release. “So to put a fine point on this, during the pandemic, the ratio between CEO and worker pay jumped 23 percent.”

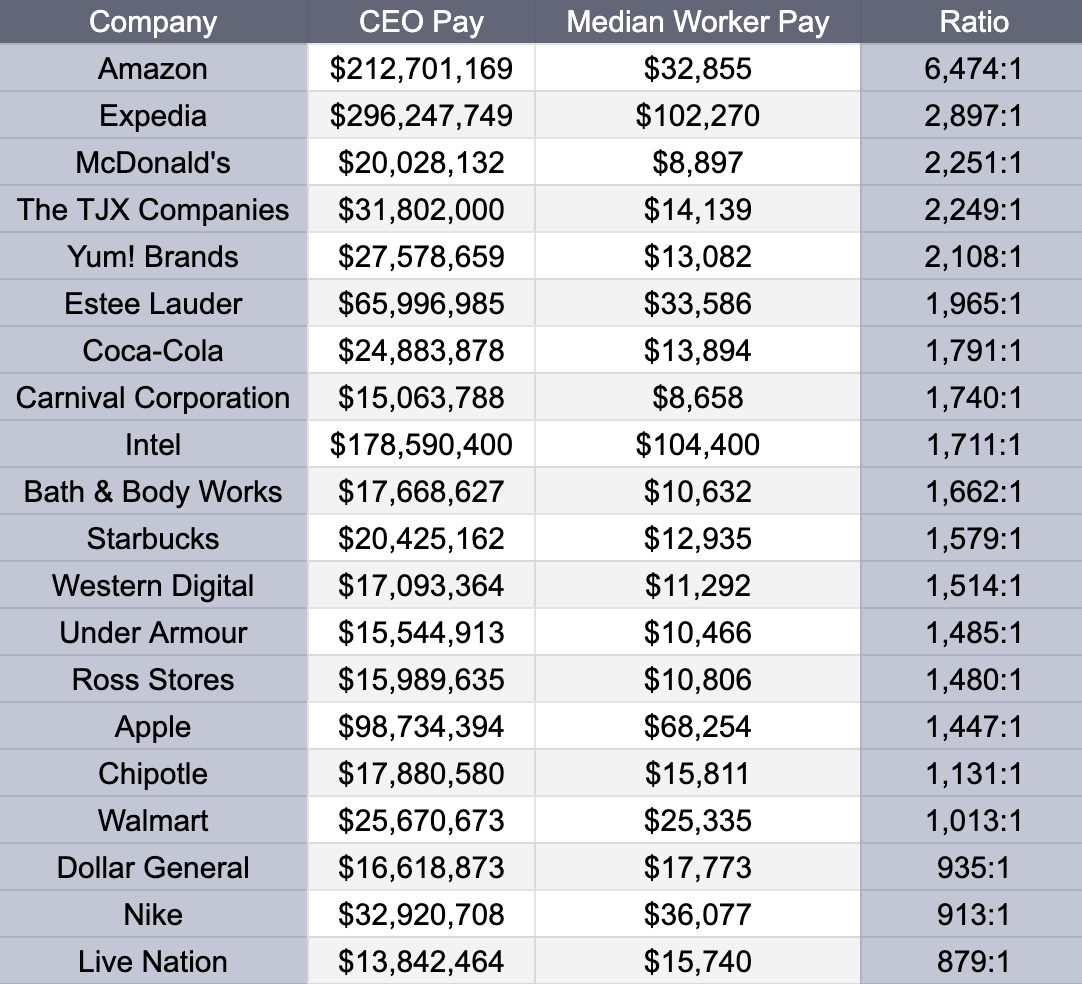

The study highlights how Greedflation—rising prices to fuel increased corporate profits and CEO compensation during a time of decreased wages—is what’s actually fueling inflation. You should really check out their entire searchable database of CEO salaries & CEO-to-worker pay ratios. But if you don’t have time, I’ve compiled some of the worst offenders for you here:

Source: AFL-CIO

Beyond astronomical executive compensation and a growing pay disparity, corporate profits are at 70-year record highs and stock buybacks are continuing to enrich an already comfortable investor class. In 2021, there was a record level of stock buybacks—$881.7 billion—which was a nearly 70% increase from 2020.

But unlike wealthy CEOs, wages for working people actually fell, in part because of inflation eating away what meager gains some workers had attained. Still, federal officials join corporate elites in blaming workers—not corporate profiteering—for rising costs. Julia Rock wrote in The Lever recently:

“At a May 4 press conference in which [Federal Reserve Chair Jerome Powell] announced a .5 percent interest rate hike, the largest since the year 2000, Powell said he thought higher interest rates would limit business’ hiring demand and lead to suppressed wages. As he put it, by reducing hiring demand, ‘that would give us a chance to get inflation down, get wages down, and then get inflation down without having to slow the economy and have a recession and have unemployment rise materially.’”

AFL-CIO’s findings debunk claims made by Wall Street and the Federal Reserve that workers wages are somehow responsible for historic inflation that disintegrating what little disposable income working families have.

“Wall Street elites have been quick to blame workers’ wages and low unemployment for causing inflation. But in reality, U.S. workers’ earnings actually fell behind inflation, rising just 4.7% in 2021. In real terms, average hourly earnings fell 2.4% last year after adjusting for inflation,” Redmond said.

Working people are buckling under the weight of this Greedflation and it’s pushing people further into the margins. The value of the federal minimum was is now at its lowest point since 1956. Working people have never lost this much purchasing power through disposable in one year and, as a result, are increasingly racking up credit card debt to afford essentials. Just 14% of people surveyed said their credit card bills decreased over the last three months.

We recently reported on a study by ParentsTogether Action that found 90% of families were struggling to afford the cost of living with many of them skipping meals so their children could eat. As a result, food banks are scrambling to meet increased demand despite record years for food companies.

Food company giants are boasting record profits and 62 new “food billionaires” were created during the pandemic. Cargill, the US-based global food corporation and largest privately held corporation in the country, is expecting record profits this year. These profits come on the back of working people who are now paying substantially more for groceries than at this point last year.

Corporate greed won’t magically disappear, and with a Congress unwilling to take it on headfirst workers must affect change themselves. Redmond says there’s cause for optimism.

“But working people are starting to fight back against the economics of Greedflation. From Bessemer, Alabama to Staten Island, New York, Amazon workers are coming together to form unions and negotiate for a fair return on their work,” Redmond said. “And it’s not just Amazon workers who are exercising their freedom to unionize. Petitions with the National Labor Relations Board by workers to form unions jumped 69 percent in the first half of this year compared with the previous period in 2021.”

Thank you for reading. If you enjoyed this piece, please share it and leave a comment. And if you’d like to subscribe to this Substack, can do so below. A portion of proceeds from monthly subscriptions goes to groups supporting our unhoused friends and neighbors. You can nominate an organization to be a beneficiary by replying to these emails.

Photo courtesy of Tracy O/Creative Commons

Thank you. This is a very informative, to the point and in-depth covering of the ongoing crisis effecting the majority of the people.

Jesus fuck those graphs.