1 In 3 Adults 50+ Forgo Food, Medicine Or Other Necessities To Pay For Healthcare

More than a third of adults 65+ worry they won't be able to afford medical services next year.

Aging with dignity in the United States is increasingly becoming more difficult.

Rapidly rising medical costs, corporate greed and inflation are stretching our country’s elderly population far too thin. Millions of honest, hardworking people are watching their dreams of a humble retirement disintegrate.

A new poll from Gallup found that basic needs—meals, clothing, utilities—are being neglected to a varying extent by elderly Americans because they are being price-gouged by the healthcare industry.

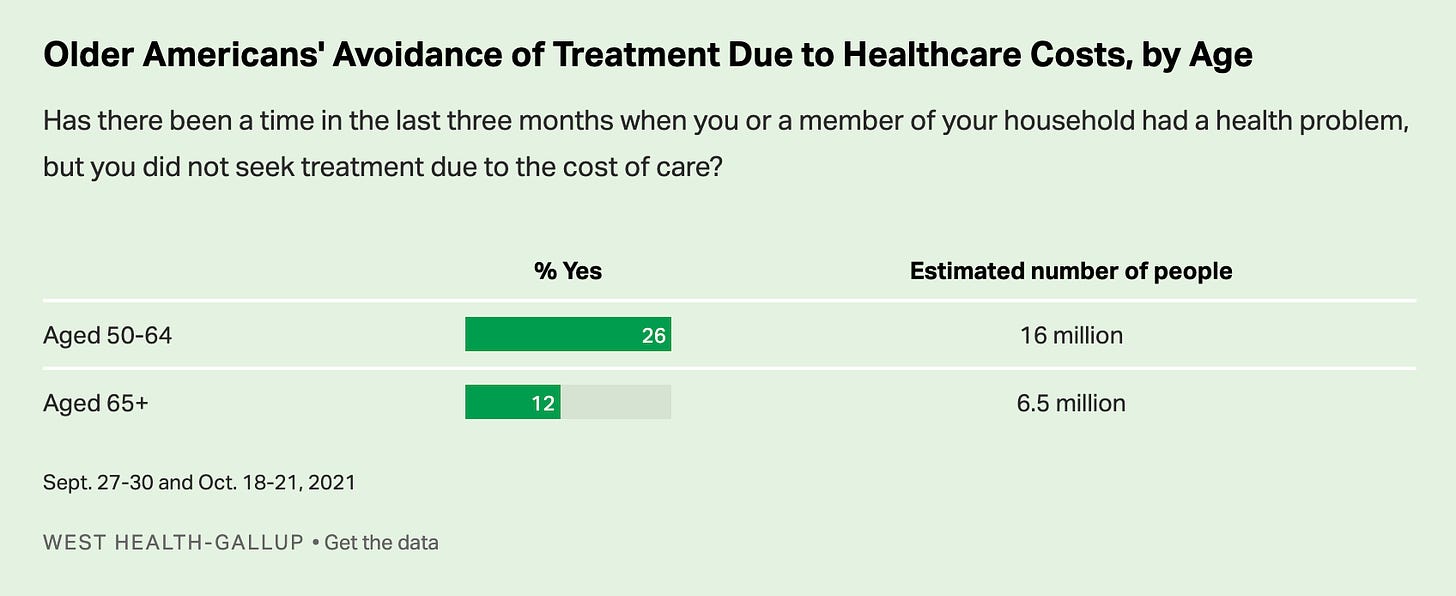

Over 60% of Americans 50+ say healthcare costs are at least a minor financial burden. An estimated 22.5 million people 50+ reported avoiding medical care due to the cost in the three months before the poll.

More than a third of adults 65+ worry they won't be able to afford medical services next year. Nearly half of Americans aged 50-64 (currently ineligible for Medicare) report feeling similarly. “This puts nearly 50 million adults aged 50 and older at risk for more severe illness and even death due to the cost of healthcare,” according to Gallup.

While Medicare covers a vast majority—94% in 2019—of elderly Americans, it doesn’t cover everything. Medicare Part C, often referred to as Medicare Advantage, is supplementary coverage through a private insurer that covers things like dental, vision, hearing and wellness.

With this as a backdrop, I want to explore the broader affordability and cost of living crisis affecting older Americans. To start, there’s one more healthcare aspect we need to discuss.

Prior authorizations in the healthcare industry are a total scourge.

If you don’t know what prior authorizations are, it’s when your doctor recommends a procedure and instead of, you know, getting that procedure next you have to get approval from someone who isn’t a doctor at your health insurance company.

I’m sure you can see the obvious conflict of interest—insurance companies have a financial incentive to deny those requests.

A report from the Department of Health and Human Services revealed Medicare Advantage plans issue millions of denials every year. Of those millions of denials, tens of thousands were for medically necessary care that should have been covered. While there are now calls for greater “accountability” and “scrutiny”—the go-to demands in Washington whenever something everyone kinda knew was happening finally gets confirmed—it doesn’t make up for the fact that countless peoples lives were affected by unchecked corporate greed that was injected into what is ostensibly a public service.

Some of the stories are absolutely heartbreaking. Reed Abelson wrote in the New York Times:

“Kurt Pauker, an 87-year-old Holocaust survivor in Indianapolis who has kidney and heart conditions that complicate his care, is enrolled in a Medicare Advantage plan sold by Humana,” Abelson wrote. In spite of recommendations from Mr. Pauker’s doctors, his family said, Humana has repeatedly denied authorization for inpatient rehabilitation after hospitalization, saying at times he was too healthy and at times too ill to benefit.”

He’s like Schrödinger’s patient. Too healthy to help. Too ill to help. He’s everything and nothing all at once. Whatever he is, Humana just doesn’t want to foot the bill.

So seniors either foot the bill themselves—if they can afford it (from 2009 to 2019, out of pocket costs for medical expenses for seniors have risen 41%)—or they just don’t get the care they need.

As the Gallup survey illustrated, the financial burden increased medical costs has created is fundamentally reshaping the way Americans retire and defining if they can retire or stay retired. And, if they rely primarily on Social Security, retirement is becoming a pipe dream.

Social Security comprises a majority of retirees income. For 10 million of them, it’s 90% of their income. The average monthly Social Security benefit in 2022 is $1,658. Inflation, a 40-year high of 8.6% in May, has exceeded SSA’s cost of living adjustment for the year, which was only 5.9%. In any other year, 5.9% would be a sizable increase—relatively speaking, because if you’re part of the 10 million who almost exclusively rely on Social Security, making $1,658 last a month is practically a fantasy.

For Social Security recipients at large, they face yet another obstacle. Brian Faler writes in Politico, “The nonpartisan Congressional Budget Office sees the share of Social Security benefits subject to tax growing by 10 percent this year and another 10 percent next year. It predicts total income taxes paid on those checks will jump this year by 37 percent.”

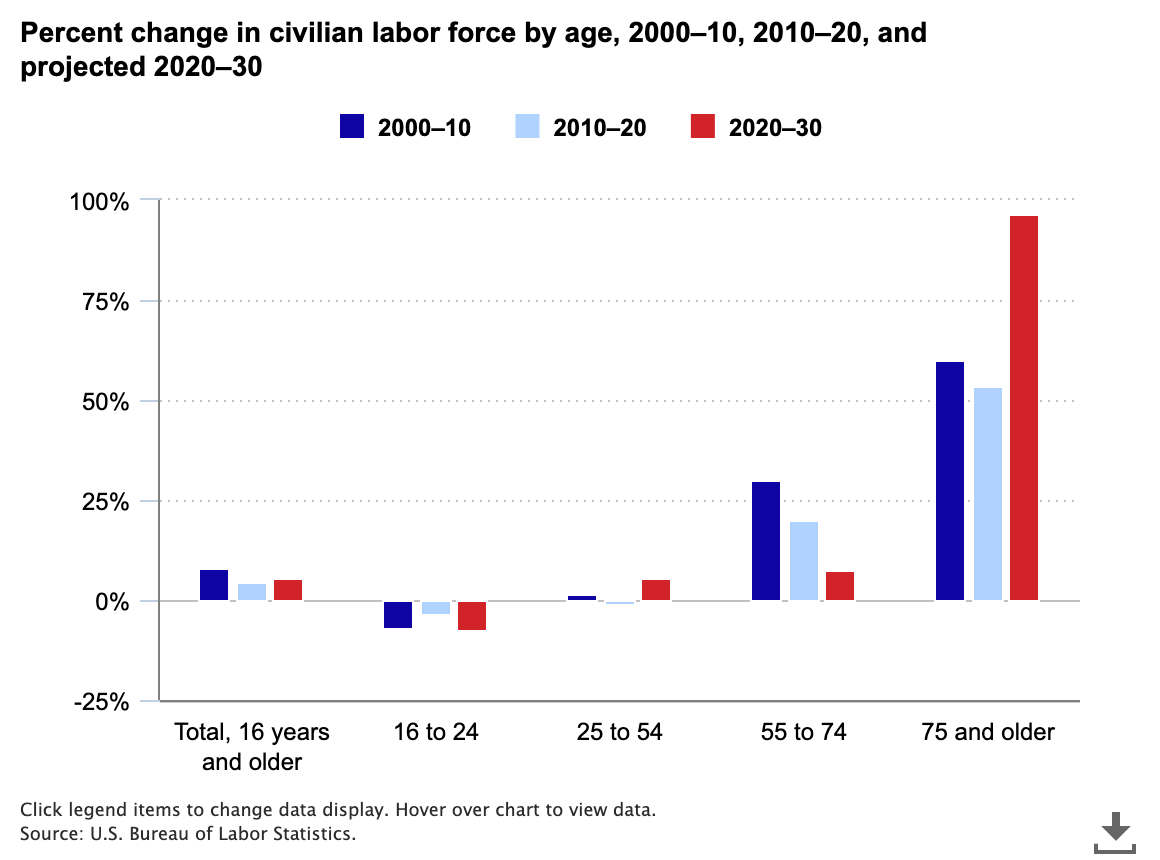

From rising healthcare costs, to rising prices due to inflation and corporate greed, to increasingly insufficient Social Security payments, elderly Americans are returning to the workforce in growing numbers.

The Bureau of Labor Statistics projects that “among people age 75 years and older, the labor force is expected to grow by 96.5 percent over the next decade.”

In early May, the Washington Post reported that 1.5 million retirees reentered the workforce over the past year.

This shouldn’t need to happen.

And as we likely enter a recession, the cost of living continues to outpace wages cost of living adjustments for seniors on fixed income, and inequality continues to worsen, that trend will likely continue.

Without meaningful changes to enhance and protect our social safety net, more elderly Americans will be forced to work in their later years just to survive.

Thank you for reading. If you enjoyed this piece, please share it and leave a comment. And if you’d like to subscribe to this Substack, can do so below. A portion of proceeds from monthly subscriptions goes to groups supporting our unhoused friends and neighbors.

Why any Medicare eligible human would use a MedAdvantage plan rather than a supplement is beyond me...except they are heavily promoted. And your article shows exactly why.